Customer Experience

As a Financial Services Institution, UOBI is committed to offer the best products and services for all customers in an inclusive manner. We strive to understand the expectations and needs of all customers by providing security, convenience and comfort in transactions.

Customer Experience and Satisfaction

Our customers are the core of our business. By actively engaging and listening to their needs, we can serve them better and create lasting relationships.

Review of Policy and Performance Effectiveness

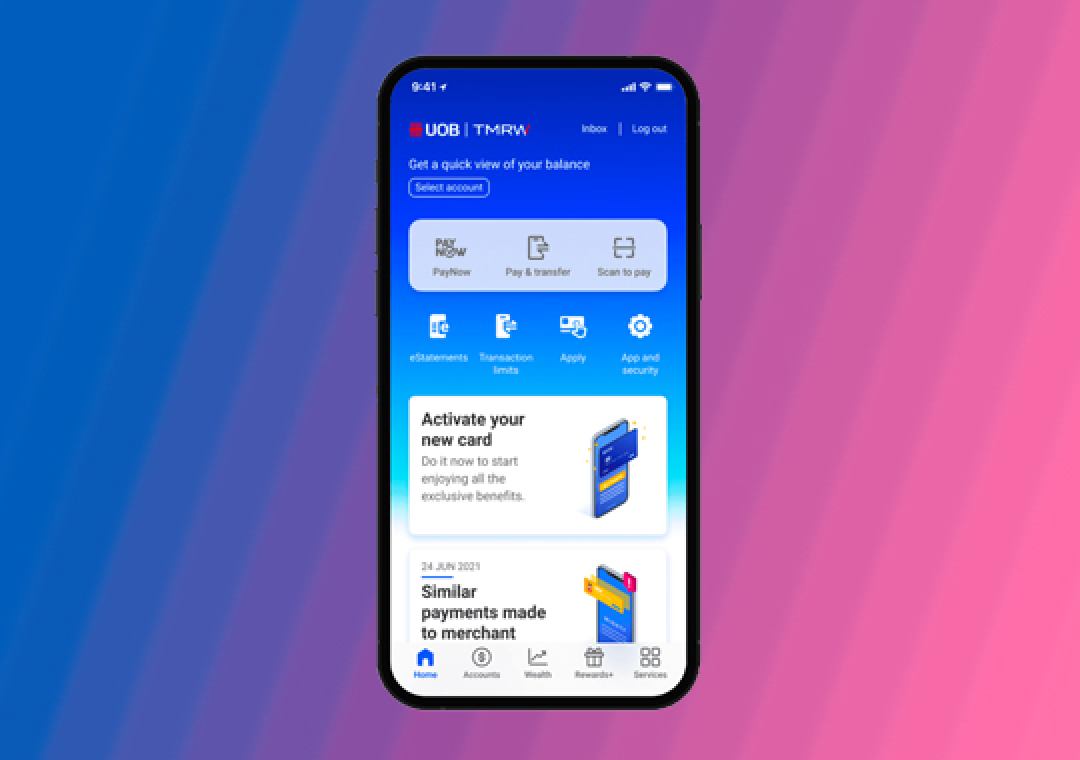

In focusing on doing what is right for customers, we act in their best interests and provide them with appropriate solutions and services through our omni- channel approach. Our culture and values - Honourable, Enterprising, United and Committed, serve as the guidelines in how we treat all of our customers.

In addition to implementing this culture and values, the UOBI Customer Commitments Awards Ceremony is held annually to recognize employees who have led and become role models in fulfilling commitments to customers. This is done to ensure that UOBI employees continue to provide the best services to customers. In 2022, we have awarded two winners in the individual category and three winners in the group category.

Improving Customer Satisfaction and Advocacy

Customer satisfaction assessment and evaluation is the key to improve our services and future business growth. We aim to receive objective feedback from our customers through the Net Promoter Score (NPS) metrics which is a proven metric to measure customer satisfaction and loyalty that is recognised worldwide. We use the Net Promoter Score (NPS) for all business lines and product. NPS is one of the tools used to measure customer loyalty, indicating the customers’

likelihood to recommend a company’s brand, products or services to others. In 2023, UOBI performed surveys using NPS methodology for the Consumer Banking business, conducted by Bain and Company with the NPS results above the industry average while for Wholesale Banking business it was conducted by Greenwich.

We frequently engage with customers by text messaging and telephone calls, particularly to interact with customers via any of the seven touch points, namely:

- credit card application, housing loan application;

- Privilege Banking on-boarding, mass market account opening, Business Banking account opening;

- contact centre servicing credit card reward redemption;

- wealth banking on-boarding

- Personal Financial Services - investment and insurance;

- Business Banking - investment and insurance; and

- problem resolution.

In addition to improve service quality, we also conduct surveys and benchmarking to review our performance and services compared to the best services in the banking industry, and identify areas for improvement.

We conduct service huddles at branches and head office as well as internal NPS surveys to improve customer service quality. Through service huddle, we encourage colleagues from all business segments to share ideas in improving customer experience. Benchmark surveys provide information that allows us expedite and simplify the account opening process. All security officers at our branches have also received training to direct the customers to the right branch representatives.