Sustainability Strategy and Approach

UOB Indonesia (UOBI) is committed to driving sustainable development by creating positive impact on the national economy, environment and society.

Sustainability Strategy

In our focus of creating sustainable value for our stakeholders, we align our long-term business strategies with their interests. We believe in sustainable development that meets the needs of the present without compromising the livelihood of future generations

We continue to provide added value to all stakeholders by integrating the eight principles of sustainable finance (set out in POJK 51) in our operating activities. These principles include:

- Principles of Responsible Investment

- Principles of Sustainable Business Strategy and Practice

- Principles of Social and Environmental Risk Management

- Governance Principle

- Principles of Informative Communication

- Inclusiveness Principle

- Prioritisation of Strategic Sector Development Principle

- Principles of Coordination and Collaboration

Sustainable Finance Action Plan

In addition, UOBI has prepared a “Sustainable Finance Action Plan” (Rencana Aksi Keuangan Berkelanjutan/RAKB) for the 2024 - 2028 period which was prepared by the Board of Directors and approved by the Board of Commissioners. During the 2023 RAKB, we have carried out the following:

- Raise internal bank awareness regarding ESG aspects

- Raise awareness of diversity and inclusivity in the work

environment

- Diverse and inclusive workforce

- Ensuring employees stay relevant to the market and trends with programs

and training

- Support and create social programs that focus on the arts, children

and education through partnerships, employee participation/volunteerism, and

corporate philanthropy

- Socialization and communication to students to improve financial

literacy

- Actively participate in marketing “Green Bonds” for Retail

Bonds

- Active in Social Activities as part of marketing BNP Paribas IDX30

Philanthropy products

- Opening the Green Property Loan classification for housing that has

Green certification

- Use of renewable energy by installing solar panels

- Waste Management implementation

- ESG Framework establishment

The Five Guiding Principles

UOBI’s approach to sustainability is guided by five principles that act as a compass for how we address the material risks and opportunities which may impact our customers, colleagues, investors, suppliers and the communities in which we operate.

![]() Forge a Sustainable Future with Our Customers

Forge a Sustainable Future with Our Customers

![]() Aligned to Business Strategy and Stakeholder Interests

Aligned to Business Strategy and Stakeholder Interests

Engage our customers proactively to influence their sustainability practices for greater long-term resilience.

Implement sustainability 3 programmes to manage ESG risks and opportunities sensibly, in line with market and competitive realities.

Align our sustainability approach with ESG policies and guidelines of governments in our key markets.

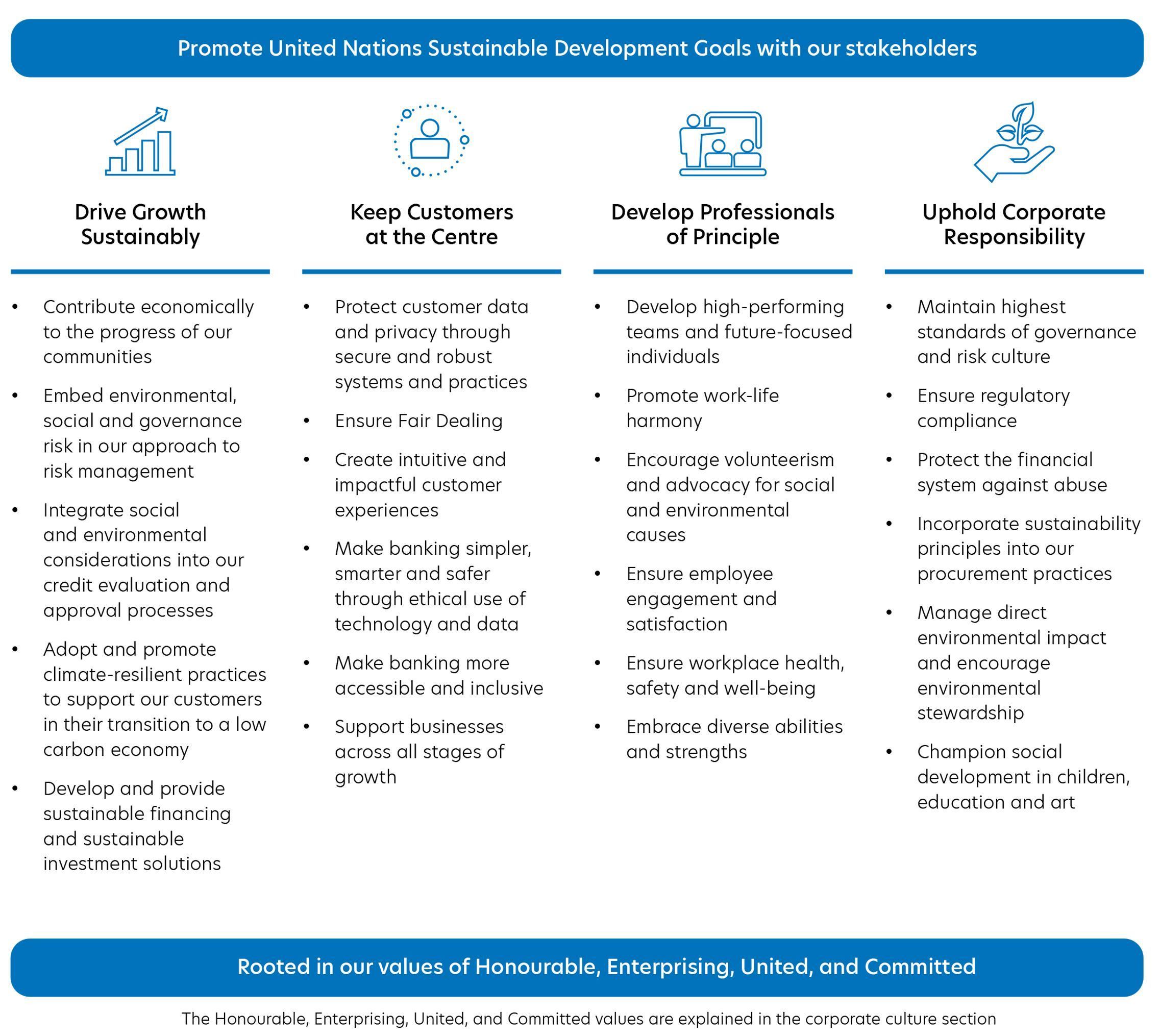

The Four Pillars

Our values of Honourable, Enterprising, United, and Committed underpin UOBI’s sustainability strategy. They will continue to guide our people, policies and processes to ensure the long-term interests of our stakeholders are met and the performance of UOBI is sustained.

The four pillars of our sustainability strategy arise from UOB Group's fundamental strengths and are rooted in our values. They reflect our expertise, the responsibilities we hold and the role we can play for the long-term benefit of our key stakeholders. Each of the pillars determines a set of objectives which we strive to achieve to ensure that we implement our strategy with clear plans and purpose.

Drive Growth Sustainably

UOBI's support for sustainable development goals is reflected in every policy it adopts, particularly when it comes to financing sustainable business activities. We incorporate sustainability risk into our risk management strategy in order to sustainably drive growth. In this instance, we incorporate ESG factors into our credit approval and evaluation procedures.

One of UOBI's concrete actions to promote environmentally- friendly development is financing renewable energy, biodiversity management and sustainable land use, and eco-friendly products in the midst of global climate change issues. We also channel financing in the MSME sector to empower economic resilience.

Keep customers at the centre

We ensure that Fair Dealing principles are entrenched in all aspects of our relationship with customers as we prioritise doing what is right for them. By keeping their best interests in mind, we harness technology and use data to make banking simpler, smarter, safer and more intuitive for them. As part of our commitment to our customers, we must safeguard their data and privacy by ensuring that our processes and systems remain secure and robust.

Develop professionals of principle

We continue to create a harmonious, inclusive and productive work environment for our colleagues by embracing diverse strengths and abilities to enhance our capabilities and enrich competitiveness.

In the midst of business challenges within the banking industry, we continue to develop the skills of our people through a series of education and training programmes. With this approach, we believe UOBI will continue to grow sustainably, be a dependable and trustworthy bank, and provide added value to all stakeholders.

Uphold corporate responsibility

We believe that as a responsible financial services provider, we must uphold corporate responsibility by maintaining highest standards of governance and risk culture, ensuring regulatory compliance and protecting the financial system. This commitment is manifested in good corporate governance and our support for social and community activities. Together, these efforts help us contribute to a strong and sustainable future for the wider community.

Supporting the Sustainable Development Goals

UOBI's Business Plan and RAKB have been tailored to and reflect our support for UN SDGs which demonstrates social and environmental responsibility and support national economic growth.

UOB is also a member of the United Nations Global Compact (UNGC) with the mission of mobilising the company's global movement to create a better world. As a signatory, UOB supports the Ten Principles of the Global Compact:

Human Rights

- Principle 1: businesses should support and respect the protection of internationally- proclaimed human rights; and

- Principle 2: make sure that they are not complicit in human rights abuses.

Labour

- Principle 3: businesses should uphold the freedom of association and the effective recognition for the right of collective bargaining;

- Principle 4: the elimination of all forms of forced and compulsory labour;

- Principle 5: the effective abolition of child labour; and

- Principle 6: the elimination of discrimination in respect of employment and occupation.

Environment

- Principle 7: businesses should support a precautionary approach to environmental challenges;

- Principle 8: undertake initiatives to promote greater environmental responsibility; and

- Principle 9: encourage the development and diffusion of environmentally-friendly technologies.

Anti-Corruption

- Principle 10: businesses should work against corruption in all its forms, including extortion and bribery.