Ready to explore the world

with UOB PRIVI Miles in your hands

UOB PRIVI Miles

#YourPassporttoFlyFree

APPLY AND ENJOY

Bonus4,000

airline miles*

airline miles*

Apply Now

Ready to explore the world

with UOB PRIVI Miles in your hands

UOB PRIVI Miles

#YourPassporttoFlyFree

APPLY AND ENJOY

Bonus4,000

airline miles*

airline miles*

Apply Now

Your Passport to Fly Free Faster

UOB PRIVI Miles Credit Card exclusively designed for those who love travelling and ready to explore the world with one card in your hand

1 Airline Miles

Rp 6.000 for foreign currency transaction

1 Airline Miles

Rp 10.000 for IDR transaction

Privileges

Travel accident insurance up to Rp 7 Billion

Enjoy free travel accident insurance coverage up to Rp 7 Billion for every air/in-land ticket purchased with UOB PRIVI Miles

Visa Signature Concierge Services

Planning for a weekend getaway or dine in a five stars restaurant? Visa Signature Concierge Services can help you plan your vacation, book flight tickets or hotel stay anytime you like.Call 001803441242 for more information.

Other Features

| Competitive SGD Exchange Rate | Shopping transactions for everything whenever you’re in Singapore just got more convenient with our competitive exchange rate. |

| UOB Regional Privileges | Enjoy discounts and special offers while you’re in Singapore at a variety of well-known restaurants, hotels, shopping centers, fashion outlets, family entertainment and various other places. |

| UOB Credit Protection | Balance protection facility with an affordable premium, which will relieve you from the obligation of paying off your balance should anything happen to yo |

| UOB Bill Pay | Monthly payment of electricity bills, phone bills, television and internet subscription can now be done via autodebit to your credit card. Contact UOB Call Center at 14008 or (021) 2355 9000 to register your bill payment |

| UOB FlexiPay | Get a special installment offer with a competitive interest rate and flexible tenure of up to 24 months for your retail transactions |

| UOB Auto Pay | If you have a UOB bank account, enjoy free auto pay facility by giving written instruction to debit your account every month on the due date of your credit card billing. You can choose to pay either total bill (100%) or minimum payment (10% of total billing). |

| Valid across the world | UOB PRIVI Miles Credit Card is accepted in more than 25 million merchants,providing convenient cash advance transaction in any ATM machines worldwide. |

| Cash Advance | Cash advance facility up to maximum of 40% from total credit limit given. Maximum cash advance limit via ATM machine is Rp 15.000.000,-/day/card. |

| 24 hours UOB Contact Center: | Call UOB Contact Center at 14008 or (021) 2355 9000 regarding UOB PRIVI Miles Credit Card information, oustanding billing information, latest transaction, remaining credit limit and report of card loss/stolen at any time |

Rewards Points Redemption Terms & Conditions

- UOB Credit Card must be active, no block, no outstanding billing and not exceeding card limit when requesting rewards points redemption.

- If in any case cardholder request for card closure before redemption process is completed, then the request will be cancelled and rewards points will be written off.

- Rewards points redemption can only be requested by main cardholder. Supplement cardholder cannot request for any rewards points redemption.

- Rewards points is valid for 2 (two) years in UOB system. Expired rewards points cannot be re-claim in any circumstances and cannot be replaced with other rewards options.

- If in any condition where rewards points have been redeemed by cardholder before rewards points redemption procedure is completed, the remaining rewards points available to redeem will be outstanding rewards points minus (-) and will be deducted in the next transactions.

- Rewards points is a form of bank's appreciation for all UOB cardholders, and cannot be redeem in the form of cash value.

- Rewards points is not transferable to other cardholders, and/or be inherited to anyone in an unforeseen condition.

- Rewards points redemption can be redeem by contacting UOB Call Center at 14008 or (021) 2355 9000.

Earn Airline Miles Faster

- Earn Airline Miles for every retail transactions locally and overseas

- 1 Airline Miles = Rp 6.000 for foreign currency transaction and 1 Airline Miles = Rp 10.000 for IDR transaction

- Airline Miles will be given in rewards points which will be posted under current rewards points earned in monthly billing statement (1 Airline Miles = 10 rewards points)

- All retail transaction is calculated from main credit card and supplement credit cards that are recorded in the Bank's system (excluding these transactions type: installment, cash advance and cash on phone)

- All overseas retail transactions is posted under overseas currency. Additional rewards points for overseas retail transaction will be credited at the maximum 1 (one) month after transaction are recorded in the Bank's system

- Rewards points is e given to main cardholders with current payment status and no block

Travel Accident Insurance Terms & Conditions

- Insurance can be claim if main cardholer or supplement cardholder experience accident as a passenger during trip in which the trip ticket is bought using UOB PRIVI Miles credit card of main cardholder. This insurance claim is also valid for married spounse and dependent children under 23 years of age.

- Trip Type:

By land/water/air conveyance operated under a license for the transportation of passenger for hire - Where the accident occured: worlwide

- Description of the condition covered of up to IDR 7 Billion:

- Decease

- Permanent disabilities in the form of:

- Both hands or both feet or sight of both eyes

- One hand and one foot

- Either hand or foot and sight of one eye

- Either hand or foot

- Sight of one eye

- Maximum aggregate limit per occurence is IDR 25 Billion

- How to claim the insurance:

- Customer call UOB Contat Center at 14008

- Submit the following supporting documents:

- KTP

- Claim submission form with event chronology

- Death certificate (if the insured passed away)

- Certificate of accident and termination of search from authorized parties (if the insured is missing)

- Doctor's certificate (visum) (if the insured has permanent disability)

- Hospital / lab receipt (if the insured underwent treatment)

- Other relevant supporting documents

- Customer can request for claim form to UOB Call Center (will be sent via email / fax)

- The maximum limit to report accident is 5 calendar days from the date of accident, in written or oral form to ABDA insurance

Annual Fee

Enjoy discounted or free annual credit card fee by redeeming your rewards point

*) 5.000 rewards points equals to discounted annual fee of Rp125.000,-, applicable in multiples

| Choice of Free Annual Fee | Amount of Rewards Points Required |

| Free Annual Fee | 40.000 rewards points |

| Discounted Annual Fee | 50.000 rewards points |

*) 5.000 rewards points equals to discounted annual fee of Rp125.000,-, applicable in multiples

Hotel Voucher

Free stay at five-star hotels with redemption starting from 175.000 rewards points

For detailed hotel list, Please click here >

Terms & Conditions

| Hotel Category | Amount of Rewards Points Required |

| Category A | 175.000 rewards points |

| Category B | 250.000 rewards points |

| Category C | 320.000 rewards points |

For detailed hotel list, Please click here >

Terms & Conditions

- Voucher code will be send to cardholder's email address registered under UOB system at the maximum of 5 (five) working days after successful rewards points redemption.

- In the case where the cardholder's email address is not registered / email address is no longer valid / the email address is different, then the cardholder is required to make changes by complying to data update procedure applicable in UOB.

- Cardholder is required to re-confirm booking by contacting Panorama JTB Tours at (021) 25565151 in order to use the voucher code.

- The booking confirmation period is 3 (three) months from the date of email containing voucher code. This period along with voucher code is also informed in the email sent to cardholder's email address.

- Voucher is valid every day throughout the year, depending on hotel room availability on the date chosen by cardholder.

- If the cardholder has not received an email containing the hotel voucher code within 5 (five) working days, the cardholder may contact UOB Call Center for request to re-send hotel voucher.

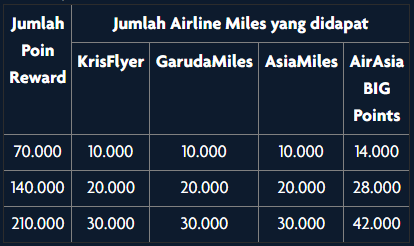

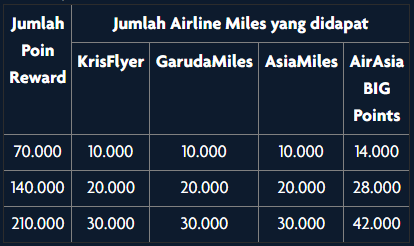

Airline Miles

Free flight tickets to your favorite destination by redeeming rewards points to Airline Miles

Rewards Points to Airline Miles Redemption Illustration

![UOB PRIVI Miles Paris Privileges]()

* The above illustration is using Economy Saver Award ticket from Singapore Airlines

* The above illustration is using Economy Saver Award ticket from Singapore Airlines

**The amount of Airline Miles required can change at any time in accordance with the terms and condition of the airlines

Rewards Points to Airline Miles Redemption Illustration

| Total Rewards Points | Total Airline Miles Received | |||

| KrisFlyer | GarudaMiles | AsiaMiles | AirAsia BIG Points | |

| 80.000 | 10.000 | 10.000 | 10.000 | 16.000 |

| 160.000 | 20.000 | 20.000 | 20.000 | 32.000 |

| 240.000 | 30.000 | 30.000 | 30.000 | 48.000 |

- Minimum rewards points redemption are 40.000 rewards points and valid in the next multiples of 4.000 rewards points

- Registered name in the Frequent Flyers partners (Krisflyer/Asia Miles/ Garuda Miles / Air Asia BIG Points) must be the same as UOB PRIVI Miles cardholder who will redeem the rewards points. Should the registered name does not match, Airline Miles transfer process will automatically fail.

Illustration: Required transaction amount and Airline Miles

Singapore (round trip) – - 15.000 Airline Miles

- Rp 60 Million for overseas transaction (Rp 5 Million / month)

- Rp 120 Million for local transaction (Rp 10 Million / month) )

Hong Kong (round trip) – 30.000 Airline Miles

- Rp 120 Million for overseas transaction (Rp 10 Million / month

- Rp 240 Million for local transaction (Rp 20 Million / month)

Japan (round trip) – 50.000 Airline Miles

- Rp 200 Million for overseas transaction (Rp 16.6 Million / month)

- Rp 400 Million for local transaction (Rp 33.3 Million / month

Sydney (round trip) – 56.000 Airline Miles

- Rp 224 Million for overseas transaction (Rp 18.6 Million / month)

- Rp 448 Million for local transaction (Rp 37.3 Million / month)

London (round trip) – 76.000 Airline Miles

- Rp 304 Million for overseas transaction (Rp 25.3 Million / month

- Rp 608 Million for local transaction (Rp 50.6 Million / month)

Paris (round trip) – 76.000 Airline Miles

- Rp 304 Million for overseas transaction (Rp 25.3 Million / month)

- Rp 608 Million for local transaction (Rp 50.6 Million / month)

New York (round trip) – 76.000 Airline Miles

- Rp 320 Million for overseas transaction (Rp 26.6 Million / month

- Rp 640 Million for local transaction (Rp 53.3 Million / month)

**The amount of Airline Miles required can change at any time in accordance with the terms and condition of the airlines