Customer Experience

As a Financial Services Institution, UOBI is committed to offer the best products and services for all customers in an inclusive manner. We strive to understand the expectations and needs of all customers by providing security, convenience and comfort in transactions.

Digital Banking

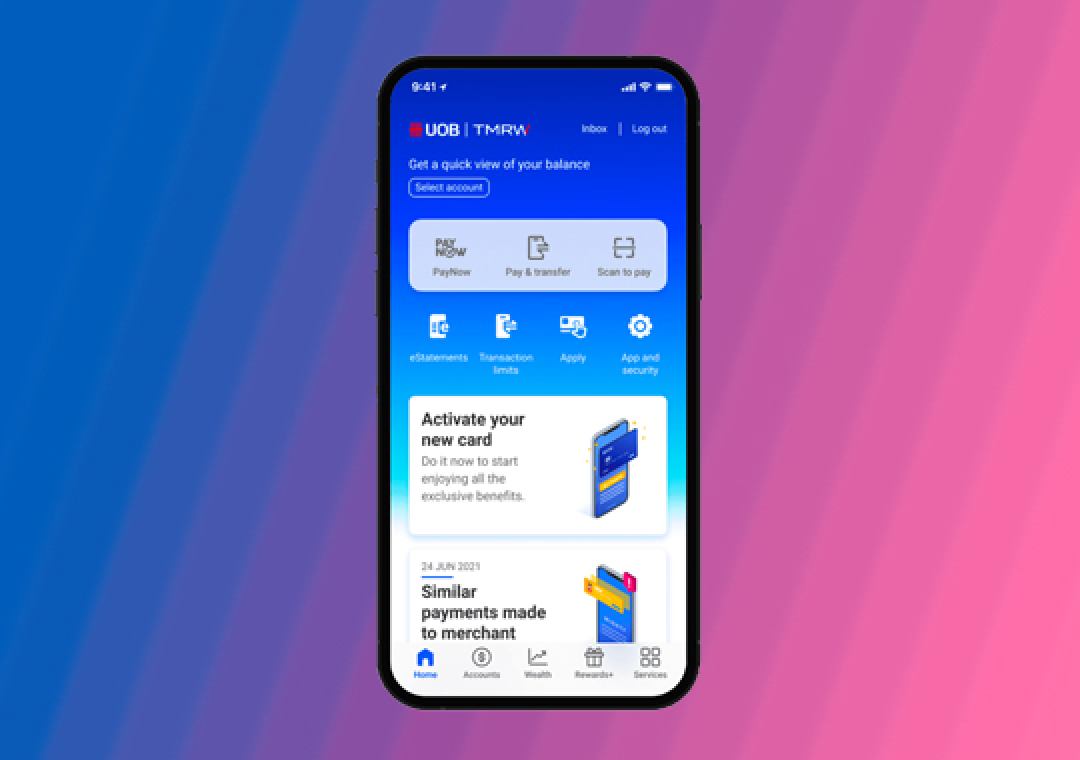

UOBI launched TMRW in 2020, the first mobile-only digital bank to cater to the financial needs and preference of the digital generation in Indonesia.

The launch of TMRW is part of our strategy to have a customised and personalised customer experience through the adoption of the latest technology, which will create a sustainable business for UOBI. TMRW is data-centric and rethinks traditional banking models to make banking simpler, more transparent and engaging for our customers — designed to fulfill the entire customer life cycle.

TMRW enables us to acquire and serve the huge base of digital-first customers across Indonesia. This complements our omni-channel approach, offering our customers the option of digital touch points to serve more advisory and complex financial needs and services such as deposit accounts, loans and credit cards.

As customers spend more time using TMRW, it becomes more familiar with their wants and needs as it translates transaction data into actionable insights to make their banking experience fun and engaging. To maintain a good experience and 24/7 interaction with customers, TMRW is equipped with a chatbot called TIA (Tomorrow Intelligent Assistant), with its interface taking reference from popular messaging apps. TIA engages in communication with the customers and connect customers to human assistant seamlessly without them having to exit or toggle away from the TMRW app. TIA also provides prompt responses and solutions for customers.

Review of Policy and Performance Effectiveness

In 2023, UOB Indonesia updated the TMRW app to UOB TMRW with a new interface and features that provide the best digital banking services to customers. These improvements also enhance the digital customer experience through:

- The launch of Rewards+ as customer access to view offers from UOB and its partners, and an easy way to redeem customer reward points.

- The launch of the Wealth menu to provide an overall view of the customer's portfolio, including ongoing investments.

Furthermore, UOB Indonesia has been acquiring new TMRW customers through various initiatives during the year:

- Establishing partnerships with various entities from online transportation, e-commerce, and online travel, conducting marketing campaigns through placements in conventional and online media, and acquiring new customers from various communities;

- Implementing a digital marketing strategy utilising employee and customer referral programs;

- Developing attractive bundling products (Savings with TMRW Credit Card and TMRW Pay) that offer various special promotions for Credit Card and TMRW Pay customers;

- Developing a comprehensive partnership base with more than 150 billers and over 50 partner merchants; and.

- Launching a mobile version of infinity.

Customer Experience and Satisfaction

Our customers are the core of our business. By actively engaging and listening to their needs, we can serve them better and create lasting relationships.

Review of Policy and Performance Effectiveness

In focusing on doing what is right for customers, we act in their best interests and provide them with appropriate solutions and services through our omni- channel approach. Our culture and values - Honourable, Enterprising, United and Committed, serve as the guidelines in how we treat all of our customers.

In addition to implementing this culture and values, the UOBI Customer Commitments Awards Ceremony is held annually to recognize employees who have led and become role models in fulfilling commitments to customers. This is done to ensure that UOBI employees continue to provide the best services to customers. In 2022, we have awarded two winners in the individual category and three winners in the group category.

Improving Customer Satisfaction and Advocacy

Customer satisfaction assessment and evaluation is the key to improve our services and future business growth. We aim to receive objective feedback from our customers through the Net Promoter Score (NPS) metrics which is a proven metric to measure customer satisfaction and loyalty that is recognised worldwide. We use the Net Promoter Score (NPS) for all business lines and product. NPS is one of the tools used to measure customer loyalty, indicating the customers’

likelihood to recommend a company’s brand, products or services to others. In 2023, UOBI performed surveys using NPS methodology for the Consumer Banking business, conducted by Bain and Company with the NPS results above the industry average while for Wholesale Banking business it was conducted by Greenwich.

We frequently engage with customers by text messaging and telephone calls, particularly to interact with customers via any of the seven touch points, namely:

- credit card application, housing loan application;

- Privilege Banking on-boarding, mass market account opening, Business Banking account opening;

- contact centre servicing credit card reward redemption;

- wealth banking on-boarding

- Personal Financial Services - investment and insurance;

- Business Banking - investment and insurance; and

- problem resolution.

In addition to improve service quality, we also conduct surveys and benchmarking to review our performance and services compared to the best services in the banking industry, and identify areas for improvement.

We conduct service huddles at branches and head office as well as internal NPS surveys to improve customer service quality. Through service huddle, we encourage colleagues from all business segments to share ideas in improving customer experience. Benchmark surveys provide information that allows us expedite and simplify the account opening process. All security officers at our branches have also received training to direct the customers to the right branch representatives.