Supporting Business for Sustainable Development

UOBI encourages the role of other business players (customers) to directly and indirectly drive sustainable development.

One of the elements of sustainable development is the urgency of preserving the environment as the carrying capacity of human- life resources. For example, net zero commitments globally has driven the business ecosystem growth oriented towards environmentally-friendly products and services.

In addition to driving environmentally-sound business activities, UOBI also supports business growth in MSME sector.

We play a fundamental role in supporting our clients:

- seize new revenue streams and growth opportunities;

- be rewarded by various stakeholders such as policy-makers, investors and consumers for their sustainability efforts; and

- benefit from an enhanced long-term reputation.

With our sectoral expertise, experience, capacity and ecosystem partnerships, UOBI is positioned to support our clients on their transformation journey.

Our Policy and Commitments

UOBI integrates all financing decisions to produce positive impacts and to reduce potential harm to society and the environmental ecosystem. We align our financing framework and procedures with internationally recognised standards and principles.With our sustainable financing frameworks, UOBI supports the national sustainable development agenda

Review of Policy and Performance Effectiveness

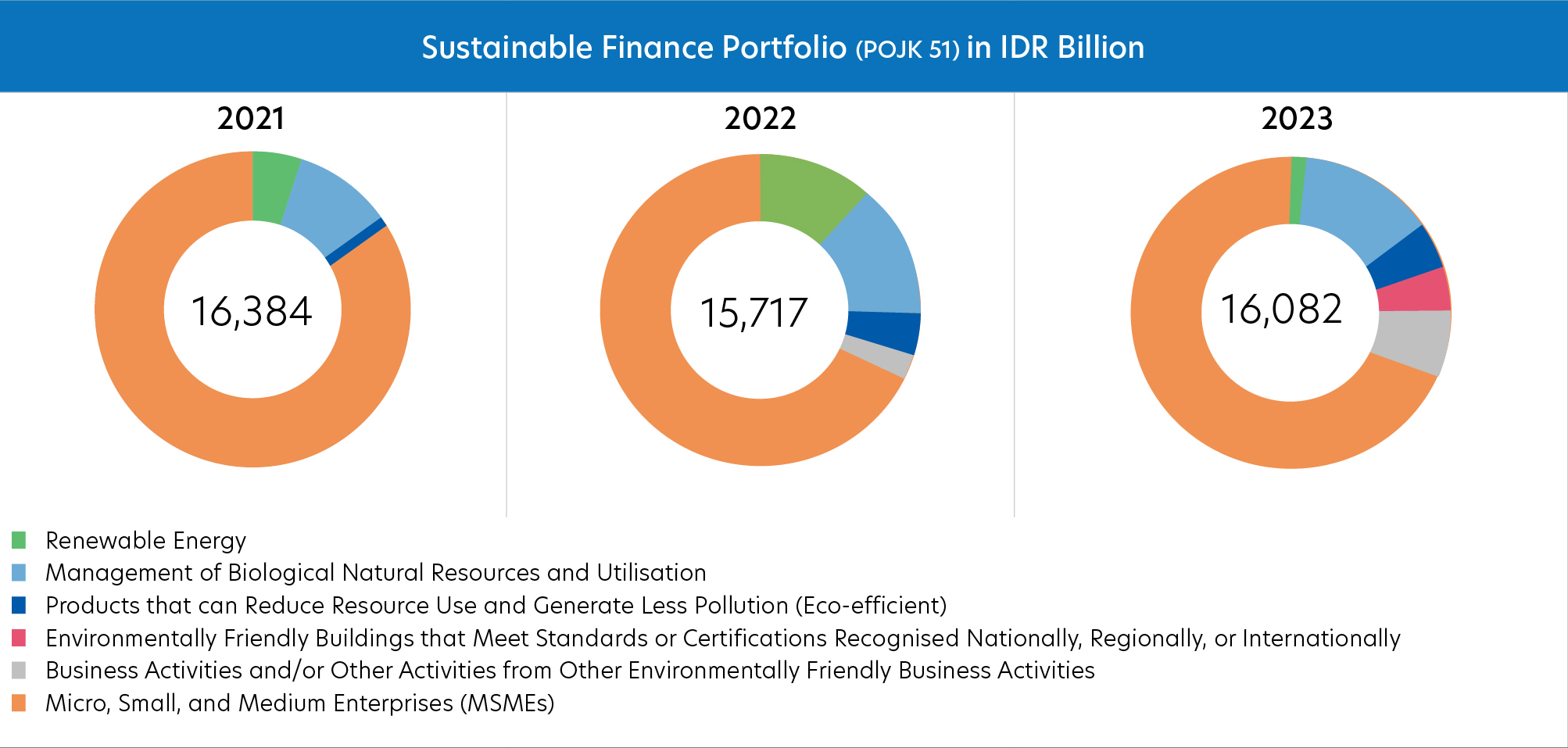

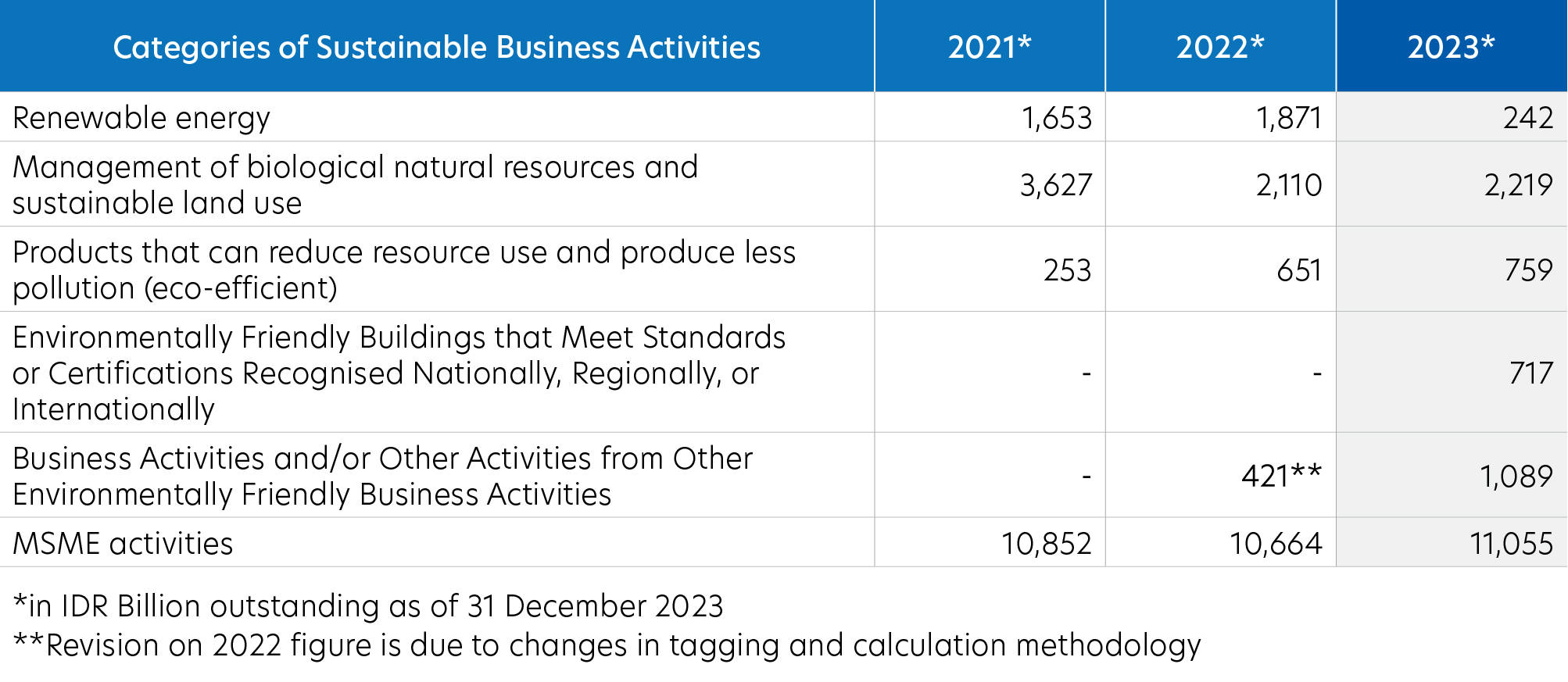

Throughout 2023, in order to support the sustainability-oriented businesses, we have disbursed financing for Sustainable Business Activities:

- based on OJK Framework: IDR16,082bn

- basedonUOBFramework: IDR2,886bn

For our business partners, a sustainable business approach requires adaptation in terms of policies, technology, costs, and human resource capacity. As a result, we continue to provide the highest quality services and advice to assist them in implementing sustainability into their businesses.

In implementing sustainability-related policies and procedures, UOBI received no complaints from our customers and recorded no negative impacts.