Frequently Asked Questions

UOB Indonesia Savings Product

FAQ

What are deposits, savings, and time deposits?

Deposits are funds entrusted by the public to Bank under a savings agreement in the form of checking accounts, time deposits, certificate of deposit, savings accounts, and/or other similar forms.

Savings are deposits that can only be withdrawn under certain agreed conditions, but cannot be withdrawn with checks, demand drafts, or other similar instruments.

A time deposit is a type of Bank deposit that has a specific term and cannot be withdrawn before maturity. Funds held in a time deposit earn interest at a higher rate than regular savings. If a time deposit is withdrawn before maturity, a penalty fee will be charged, and the accrued interest will not be paid.

What are the types and interest rates of savings and time deposits at Bank UOB Indonesia?

Types of savings available at Bank UOB Indonesia (“UOB”) include:

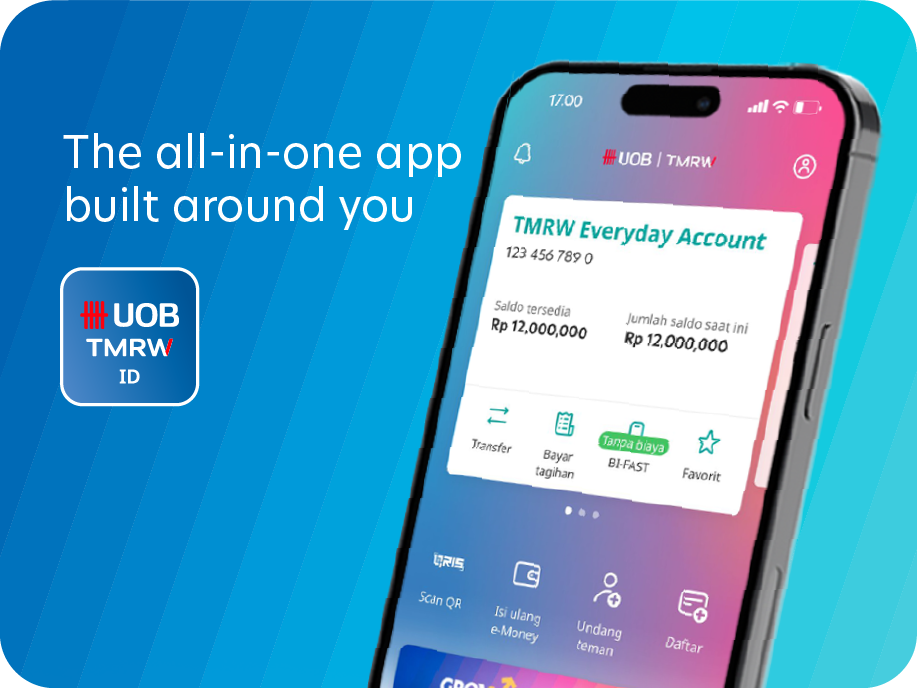

• TMRW Everyday Account

• TMRW Savings Account

• ONE Account

• Stash Account

• Lady’s Account

• Privilege Account

• Valas Produktif (with currency options are USD, SGD, HKD, GBP, AUD, EUR, JPY, NZD, CHF, CAD, SEK)

• U-Save

• U-Plan

• TabunganKu

• Simpanan Pelajar (specifically for customers aged 17 years and under only).

Types of time deposits available at Bank UOB Indonesia include:

• TMRW Power Saver

• Deposito Berjangka Rupiah

• Deposit Berjangka Valuta Asing

Time deposits are available in a variety of tenors. Interest rates for each type of savings and time deposit can be found by clicking here.

How to open a savings account at Bank UOB Indonesia? What requirements and documents are required?

Account opening can be done through the nearest UOB branch or through the UOB TMRW application (for digital products).

To open an account through UOB branch, the requirements and documents that must be completed are as follows:

- Minimum age 17 years.

- Complete the account opening and/or product placement form and other documents required by UOB.

- Submit a photocopy and show original proof of valid personal identities (ID card for Indonesian citizens, or passport and KIMS/KITAS/KITAP for foreigners, also NPWP which has been matched with NIK).

To open an account via UOB TMRW App, please visit UOB TMRW App, please visit the link here.

Do you get an ATM/Debit card if you open a savings account?

Yes, for certain types of savings accounts. ATM/Debit cards can be obtained at the opening branch or sent (for digital products) to the customer’s correspondence address.

Are savings and time deposits are guaranteed by the Indonesia Deposit Insurance Corporation (IDIC)?

Customer’s savings and time deposits are guaranteed by the Indonesia Deposit Insurance Corporation (IDIC / LPS – Lembaga Penjamin Simpanan) or another institution that may replace it in the future, equivalent to IDR 2,000,000,000 or another amount to be determined by the LPS, including if the customer receives a Bank interest rate that is lower than or equal to the interest rate set by the LPS or another institution that may replace it in the future. For more information, please visit the link here.

How do I withdraw a time deposits or close a savings account?

Time deposits withdrawals and savings account closures can be done at the nearest UOB branch. For TMRW Everyday Account, TMRW Savings, and TMRW Power Saver accounts, the conditions apply.

What format will the Bank provide a summary of savings transactions?

Bank provides a summary of savings transactions in the form of a Bank statement, e-statement, or passbook, according to the terms and conditions of each savings product.

What is the definition of an inactive (dormant) account?

An account without activity or transactions made by the customer for a period of 6 months or more.

How do I activate a dormant account?

Dormant accounts can be activated at the nearest UOB branch, or through the UOB Contact Centre or TIA in the UOB TMRW app for TMRW Everyday Accounts.

Why can the maturity date of a time deposit shift?

The maturity date of a time deposit can shift due to several factors, particularly those related to holidays or the automatic rollover (ARO) system. If the maturity date of a time deposit falls on a national holiday, collective leave, or weekend, the maturity date will shift to the next business day.

Is there a penalty if I withdraw a time deposit before maturity?

Yes, there is a penalty of 1% for Rupiah time deposits and 0.50% for foreign currency time deposits. However, there is no penalty for withdrawing TMRW Power Saver before maturity.

Are there any special promotions available to savings and time deposit customers?

For more information regarding savings and time deposit promotions, please visit the link here.